by Scott Patchan

A changing grid, new construction realities, and the materials shaping what comes next

- Undergrounding is accelerating nationwide as utilities, municipalities, and developers respond to extreme weather, electrification, grid modernization, and long-term reliability demands.

- New tools, installation methods, and conduit technologies are reshaping how buried utilities are designed and built.

- Material selection matters more than ever as contractors seek lower labor costs, extend system life, and reduce risk during long pulls and complex layouts.

Underground Utilities in 2026

Burying utilities isn’t a new concept; however, the forces reshaping the U.S. power and communications landscape are making it newly urgent. Across the country, municipalities, developers, contractors, and utilities are facing a set of pressures that overhead infrastructure wasn’t designed to withstand: extreme weather, higher electrical loads from rapid electrification, unprecedented data center growth, and aging transmission and distribution systems that are reaching their limits.

At the same time, underground construction methods, digital design tools, and conduit technologies have rapidly advanced to improve installation practices and lower lifetime system costs. Undergrounding is shifting from a specialized strategy to a mainstream infrastructure approach, grounded in durability, labor efficiency, and long-term reliability.

From Overhead to Underground: Long-Term Strategies for Evolving Grid Needs

Hurricanes, ice storms, wildfires, and even everyday vehicle impacts have become major cost drivers for utilities, affecting not just repair budgets but regulatory scrutiny, insurance exposure, and customer expectations. The cost associated with a single weather event can quickly erode years of savings from lower-cost overhead lines.

Underground systems, by contrast, are protected from environmental exposure, meaning cable and conduit age more slowly, fail less often, and recover more predictably. Their lifespan is exponentially longer, particularly when installed in appropriate conduit systems designed to mitigate heat, corrosion, fault damage, and soil movement.

Contractors understand that underground installation routinely saves on labor, not just long-term costs. When crews use lightweight materials and prefabricated duct bank, fewer man-hours are required and onsite complexity is reduced. As the industry continues to navigate skilled-labor shortages, those efficiencies matter more than ever.

What’s Happening Across the Country: A Look at Key Projects

California: Scaling Up and Driving Costs Down

PG&E’s wildfire-mitigation undergrounding program has now passed a major milestone. Since 2021, the utility has constructed and energized more than 1,100 miles of underground powerlines. Costs, once exceeding $4 million per mile, have dropped to roughly $3.1 million, with a target of approximately $2.8 million per mile by the end of 2026 as designs and processes continue to standardize.

The program remains the largest undergrounding initiative in the United States and a leading example of how scale and repetition can meaningfully reduce unit costs.

Florida: A Full-City Transformation

In Winter Park, one of the longest-running municipal undergrounding efforts continues to move steadily toward a projected 2030 completion. The city’s distribution lines are now about 80% underground, with Winter Park’s financial analysis showing an estimated $70 million in net savings compared to the overhead model. The result is fewer outages, fewer repairs, and more stable local rates.

Winter Park demonstrates the long-term economic value undergrounding can deliver.

Michigan: Piloting a Model for the Midwest

Consumers Energy has begun implementing a $3.7 million pilot program to bury 10 miles of overhead lines across six counties. While modest compared to California’s buildout, the pilot is strategically designed to measure outage reduction, long-term reliability improvements, and cost-effectiveness in Michigan’s soil and climate conditions.

With Consumers Energy serving about 1.9 million electric customers, the lessons from this pilot could influence undergrounding strategies across the Midwest for years to come.

Technology is Reshaping How Contractors Build Underground

Perhaps the most crucial shift of the past few years isn’t in policy, it’s in the tools contractors now bring to the jobsite.

- BIM/Revit modeling enables engineers to map entire underground utility corridors, including electrical, fiber, water, and sewer, before a trench is ever opened.

- Cable pulling software estimates tension, sidewall pressure, and lubrication requirements, preventing mid-pull surprises.

- Construction intelligence platforms like Trimble and ConstructConnect give estimators a view into what’s bidding, which materials are being specified, and where future opportunities lie.

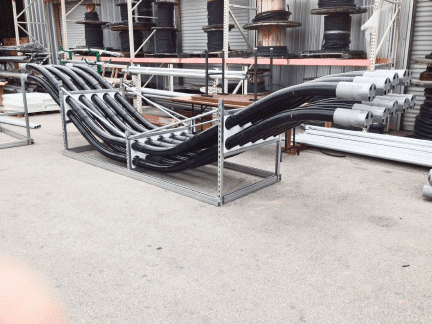

- And across the country, more contractors are turning to prefabricated duct banks delivered complete from the manufacturer. These assemblies reduce trench time, reduce worker exposure, accelerate schedules, and decrease labor costs.

Undergrounding is becoming more predictable and more efficient than ever before.

Choosing the Right Conduit: Why Material Matters More Underground

Underground installations vary widely by soil conditions, voltage, depth, load, backfill, water table, and environmental exposure. Selecting the right conduit system is one of the most important decisions a contractor or engineer will make.

Rigid steel remains a dependable choice for areas with extreme mechanical stress, but its weight introduces safety and labor challenges, especially in narrow or deep trenches.

PVC is widely used for short runs and standard distribution, but it has well-documented vulnerabilities: heat deformation, burn-through during difficult pulls, and melting during faults.

PVC-coated rigid steel offers corrosion protection but carries the weight and handling challenges of metallic systems.

Increasingly, engineers and contractors are turning to fiberglass conduit (RTRC) for medium-voltage distribution, industrial infrastructure, and long-distance pulls. Its advantages include:

- Low coefficient of friction, enabling longer, smoother pulls

- Lightweight handling that reduces worker strain and increases trench safety

- Corrosion and chemical resistance

- Elbows that do not burn-through

- Fault resistance

- High strength relative to weight

- Thermal stability that supports consistent cable performance

In applications where lifespan, reliability, corrosion protection, and labor efficiency matter, fiberglass has become an increasingly common choice.

Avoiding Underground Installation Pitfalls

Even with the right materials, undergrounding presents challenges that require careful planning.

Equipment and Planning Failures

Undersized pullers, pulling with vehicles, or attempting long pulls without tensiometers can jeopardize both safety and cable warranties. Missing rope swivels, sheaves, or quad-blocks can delay a project and create unnecessary risk.

Burn-through in PVC elbows remains one of the most common, and costly, installation failures, particularly with long distances, tight radii, or high pulling tension.

Code Compliance and Design Standards

Underground installations must meet multiple overlapping requirements depending on project type and ownership. The NEC governs most commercial and industrial installations, while the NESC applies to utility-owned infrastructure. IEEE provides critical design and performance standards that affect conduit sizing, bend radius calculations, and thermal considerations.

Material specifications matter too: ASTM defines testing protocols for conduit performance, UL listings ensure safety compliance, and ISO 9001 manufacturing standards provide process consistency and traceability. Ignoring these requirements can void cable warranties and compromise long-term system performance.

Onsite Safety and Execution

Trench safety is critical. The lighter the material, the faster crews can work and the less time they spend in hazardous confined spaces.

When installations require custom offsets to navigate around existing structures, partnering with a conduit manufacturer that can provide custom solutions can make the difference between a seamless installation and one that stalls mid-pull.

2026 Outlook: A Turning Point for Buried Infrastructure

Looking ahead, 2026 is shaping up to be a pivotal year for buried utilities. Federal infrastructure funding continues to flow. Extreme weather events and grid-security concerns are accelerating the shift away from overhead lines. Data center growth is reshaping electric load profiles. And utilities are increasingly treating undergrounding as a long-term asset strategy rather than a reaction to storm damage.

To meet these evolving challenges, utility contractors must:

- Integrate digital planning and modeling early

- Prioritize labor efficiency through prefabrication and smarter material choices

- Evaluate conduit not by upfront cost alone but by lifecycle performance

- Treat undergrounding as a core competency, not a specialty

As 2026 begins, one thing is clear: undergrounding is becoming the new standard for modern, resilient, cost-effective infrastructure.

Build your next buried utilities project with conduit engineered for long-term performance.

Connect with Champion Fiberglass for conduit solutions that reduce labor, increase reliability, and outperform in challenging environments.