Once an affordable conduit option, the PVC pipe sector has struggled with supply chain issues and rising prices since 2020, when multiple hurricanes disrupted U.S. production on the Gulf Coast. Major producers in the area including LyondellBasell and Chevron Phillips Chemical predicted a return to business as usual within six months.

Unfortunately, the Gulf Coast was dealt another blow with the Texas freeze early in 2021, further disrupting the industry. The February storm took the world’s largest petrochemical complex offline, halting polyvinyl chloride (PVC) production for nearly a month.

Then in March of 2021 the Suez Canal blockage coupled with ever rising shipping prices affecting all goods entering the U.S. from Asia would further burden the plastics supply chain.

Consumer shifts brought about by the global pandemic added to PVC demand. COVID-related shutdowns within the U.S. are partially responsible for the construction boom, as many families embarked on home renovations during this time, increasing demand for the PVC materials commonly used in residential construction. At the same time consumers quickly veered from brick and mortar stores to e-commerce, fueling warehouse construction and contributing to swiftly rising demand for plastic resins for use in consumer packaging.

Upstream energy values, including crude oil, natural gas, and coal, also affect PVC and petrochemical pricing. Ethylene, a key component of PVC, requires naphtha from crude oil and ethane from natural gas for its production.

Events in Asia also impacted price. In October of 2021, China worked to limit emissions, impacting coal output which ultimately reduced their ability to produce carbide-based PVC. Nearly one-third of the of the world’s supply of polyvinyl resins is produced by a single supplier in China, while the country as a whole manufactures roughly one-half of the global polyvinyl resin supply.

Back in the Gulf Coast, Hurricane Ida impacted chlor-alkali production, pushing PVC production and distribution further behind. Beyond weather and pandemic related issues, scheduled maintenance has also impacted the ability of the PVC industry to keep up with demand, an issue which continues today.

By the end of 2021, resulting price increases around the world would reach record levels. In the U.S, those price hikes have continued into 2022 with one master distributor of pipe and tube products in the US contributing the increases to “the continued rising cost and shortages of PVC resin and the additives required to make PVC pipe and conduit, coupled with the high demand for finished products and long lead times.”

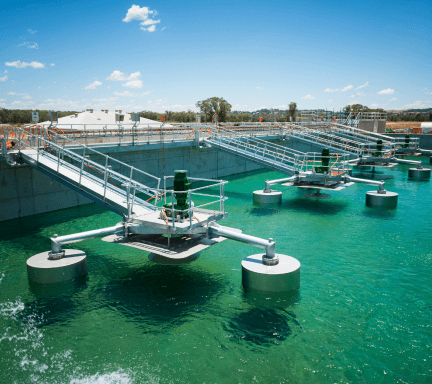

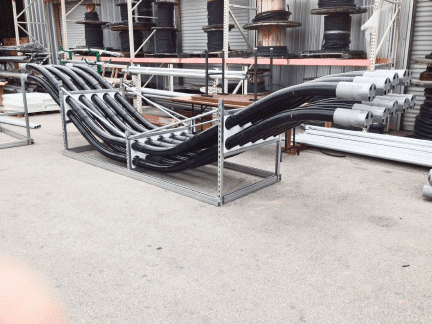

Within the electrical conduit industry, project managers continue to shift towards more cost-effective materials such as fiberglass (RTRC) conduit. Even before the supply chain issues plaguing the market in recent years, installation costs of PVC for sizes 2.5” and above have traditionally been more expensive than RTRC, per the NECA Manual of Labor Rates. This is largely due to weight. Extended support spans for RTRC vs. PVC (2X-3X the distance) as defined by the National Electrical Code (NEC) Table 355 further contribute to cost savings as fewer hangers are required. Additionally fewer pull boxes are needed for fiberglass conduit installations as RTRC allows for longer cable pulls than PVC, and the material’s superior durability contributes to reduced cost over the project lifespan.

From data centers to underground installations to distribution centers, Champion Fiberglass rep firms have had success transitioning high price PVC jobs to fiberglass conduit, even before the PVC shortage. Trevor Sorenson, Principal of Pinnacle Solutions, recalls success converting a chemical plant project to fiberglass conduit. Over a three-year process, the rep firm educated the customer until the engineers felt confident making the switch to fiberglass conduit for a small project. Now with the customer comfortable with fiberglass conduit, Sorensen adds, “We are on our sixth project with the customer.” Pinnacle Solutions continues to help other customers make the switch from PVC to fiberglass conduit for underground applications.

For a complete comparison of RTRC to PVC SCH 40, PVC SCH 80, and PVC-coated steel, download the Conduit Comparison Chart to see how U.S.-made Champion Fiberglass RTRC can provide a less costly alternative to PVC pipe for you next project.

Keep Reading

Champion Fiberglass® Named a CompositesWorld Top Shop for 2024

The origins of fiberglass date back to the ancient Greeks. Today fiberglass is used for a variety of applications from…

Get to Know Research and Development Engineer Blake Rogers

He’s got a diverse background in engineering, is new to Texas and can juggle. Meet Blake Rogers.

Electrical Conduit Cost Savings: A Must-Have Guide for Engineers & Contractors

To help identify cost savings that don’t cut corners on quality, Champion Fiberglass developed a free resource for engineers and…